Reconciling your checkbook will help ensure you have adequate funds in your account, even if the check clears weeks or months after writing it.Īvailable funds & bank fees: If you make a transaction that exceeds the available funds in your account, you may be charged overdraft fees by your bank. While banks typically refund these charges, the process can be expedited if you spot the transactions and report them as soon as possible.Ĭheck payment status: If you still fill out checks frequently, you’ve probably realized some checks get cashed long after you write them. The sooner you contact the merchant about these errors, the more likely they are to correct them in a timely manner.īudgeting & financial habits: Keeping an eye on your accounts and a record of your transactions can help you create better financial habits and make it easier to maintain a budget.įraudulent charges: If you become a victim of identity theft, an online scam or a stolen debit card, you may notice fraudulent charges in your account. Merchant errors: Merchants can also make payment processing mistakes, like charging you an incorrect amount or not processing a refund. By reconciling your account, you can ensure bill payments, deposits, transfers and other transactions are processed correctly.

Here are a few other reasons why it can be beneficial to balance your accounts:īank errors: While bank errors are rare, they do happen occasionally. Reconciling your account on a regular basis helps ensure the bank’s records match your records, and that no transactional issues have occurred.

#Balanced my checkbook how to

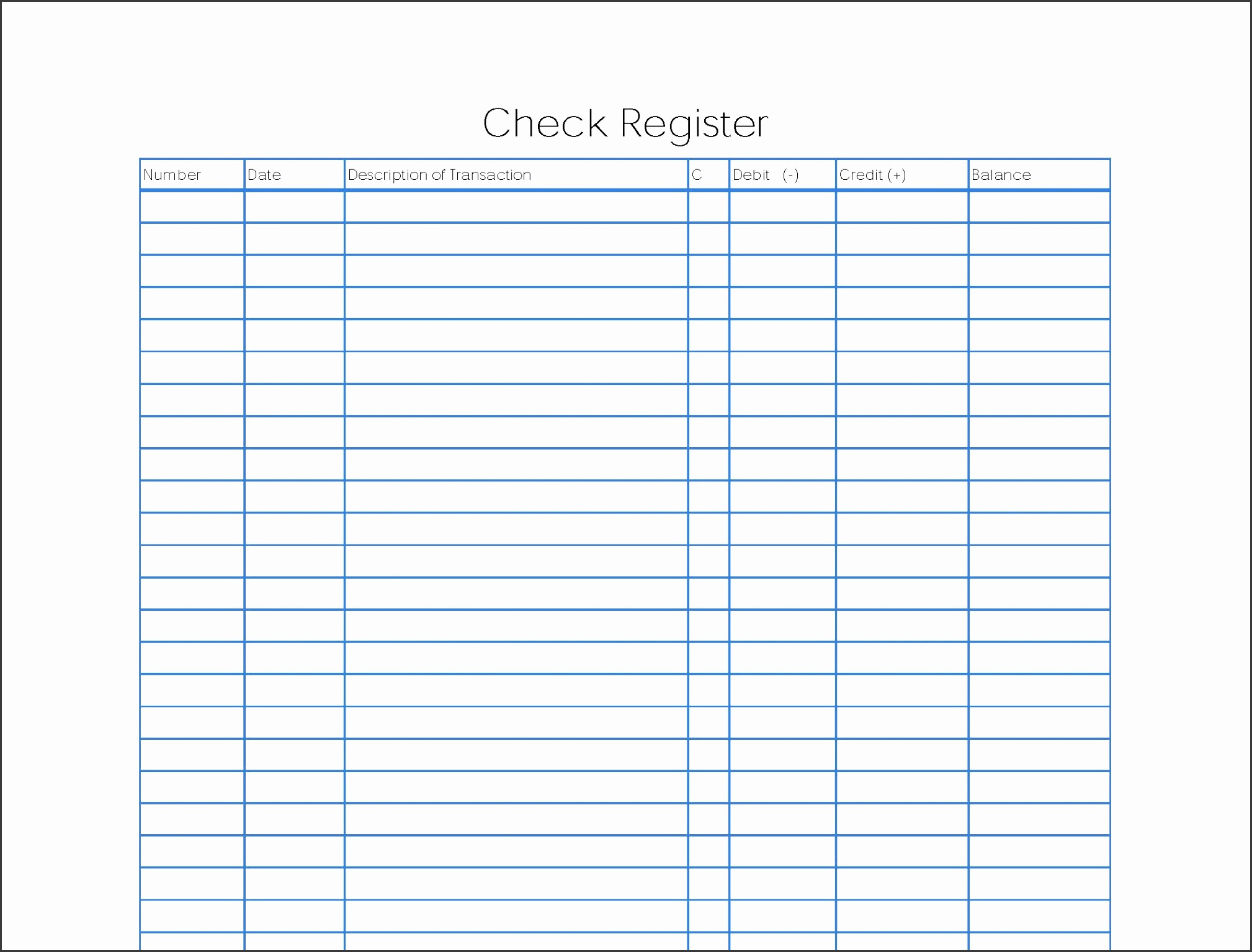

Let’s have a look at how to balance a checkbook in a digital world and why it’s still a solid practice to consider: Why balance your checkbook? Balancing your online checkbook is still a valuable practice that can help you catch accounting mistakes and foster better financial habits. Since most of us have 24/7 access to online banking and transaction records, you may be wondering whether it’s necessary to balance checkbook records in the modern financial world. Balancing a checkbook is the process of conducting a monthly reconciliation of your physical checkbook to make sure it matches the paper statement your bank mails out. *** This version is ad supported but ads can be removed with an in app purchase.Back in the good ol’ days, when it was the norm to rent VHS tapes from Blockbuster and glanced down at pagers for work updates, the practice of balancing a checkbook was an important part of maintaining financial wellness.

#Balanced my checkbook trial

Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable.Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user's Account Settings after purchase.Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period.Payment will be charged to iTunes Account at confirmation of purchase.** Terms and Conditions for Auto-renewing subscriptions It also includes access to all premium features: The subscription includes a month of access to: * The "Sync for 4 Users" subscription auto-renews monthly. Sync between other users and devices "Sync for 4 Users" is an auto-renewing monthly subscription more details below * Powerful Search to find transactions instantlyĮasy scheduling for recurring transactions Don’t let overdraft fees or pending transactions catch you by surprise - always know exactly what your account balance is with Balance My Checkbook! All you have to do is enter your expenses and income and let the app do the rest.

0 kommentar(er)

0 kommentar(er)