Good investors that are able to increase net operating income (NOI) are often able to achieve several years of cash flow in value created through forced appreciation.

If you buy a property that trades at an 8% cap rate, then raise the net operating income of the property by $5,000, you can divide that by the 8% cap rate. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream. However, more experienced investors often focus on cap rate, as it allows them to make a larger amount of money faster. It’s also easy to compare to the stock market, although this can be a bit misleading, as real estate income is generally tax advantaged compared to dividends earned in the stock market, and doesn’t take appreciation into account. Depending on the goals for your investment, one metric will be more important than the other.Ĭash-on-cash return is a great metric for investors that are looking for cash flow, as it’s easy to understand that a 20% cash-on-cash return of a $100,000 investment yields $20,000 per year. They are both very important, but for different reasons. Real estate investors will often debate which metric is more important: Cash-on-cash return or cap rate.

#Rental property evaluator how to

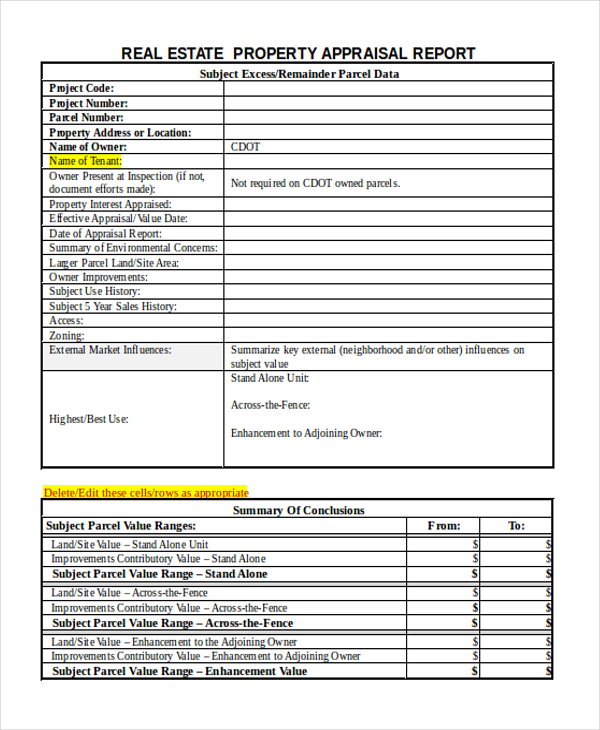

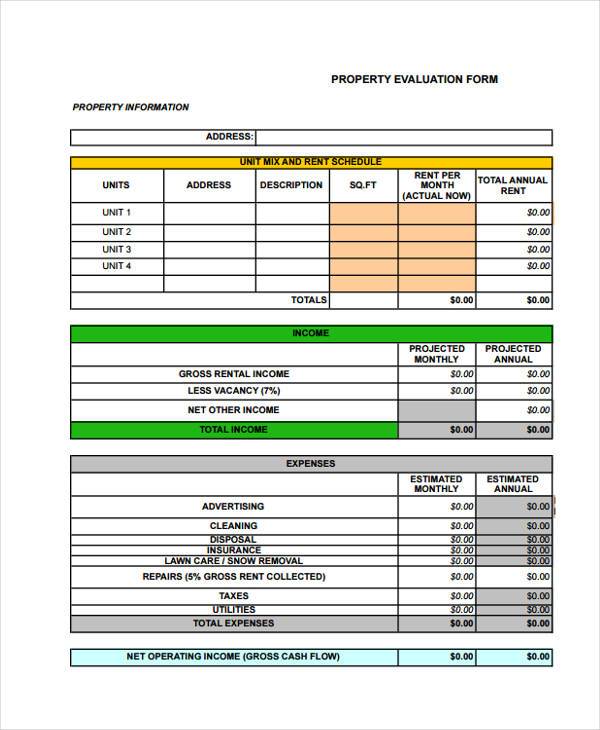

You can see this in action in the graphic above and view some related articles on how to accurately forecast renovations and repair expenses below.Ĭash-on-Cash Return vs Capitalization Rate With time, you will be able to look at pictures of a listing online and analyze the condition of a property, along with what repairs it will likely need in the future - and add that into the model. When I was a new investor, this was one of the hardest things for me to learn. With this in mind, one of the most important things you need to learn to use this model successfully is how to accurately predict expenses. In fact, you should ignore it completely for anything that rents for less than $700, as you would want closer to a 1.5% or 2% number for a deal with lower rents to pencil out. It’s worth noting that the 1% rule is just a guide and doesn’t apply to all markets. However, when hunting for deals in nicer areas, I generally look for properties that meet the 1% rule, where monthly rents are 1% or greater than the purchase price of the property, and cash-on-cash returns are above 8.5%.

With a lot of potential for appreciation in the next five or so years.įor these properties we’re aiming for above a 15% cash-on-cash return, and we’re looking for deals that we can refinance and pull out all of our capital once we finish renovations and leasing (the BRRRR Strategy). Louis market and our strategy is to mostly buy properties on “ the fringe” - areas that have good cash flow Some investors are looking for cash flow, while others are simply looking to break even on cash flow and make their money through appreciation in value and tax write-offs. When it comes to investing in real estate, a “good” return can be very different based on each individual investor and their goals. What Is a Good Return for a Rental Property? In this video I use the advanced calculator to model a real deal I found on Zillow, and talk through how I estimate expenses using just listing photos, and decide whether a deal is worth further diligence.

In this article, I’m going to give you one of the most important tools in any real estate investor’s toolbox: a financial model for rental property that you can stand behind. Properties that look nice and seem like they might be a good deal often end up being bad investments that would lose you money every single year if you made the mistake of purchasing them.Ī great rental property calculator takes the guesswork out of forecasting your cash flow, and makes it much easier to grow a profitable portfolio. However, understanding how an investment property is going to perform can be very difficult to do without the right tools. If you’re able to project how a rental property is going to perform, and you’re able to understand exactly how much cashflow you’re going to have after your mortgage and expenses, you can build a successful portfolio. While growing my portfolio, I’ve looked at hundreds, if not thousands of deals, and one thing became very clear: investing in real estate is a numbers game, and cash flow is king. Over the past few years I’ve grown my real estate portfolio from a small 4plex that I house hacked, to 22 apartments worth over $1.6 Million dollars. Ben has a rental portfolio of 22 doors, and has used the calculators in this article hundreds of times in About The Author: Ben Mizes is a real estate investor, licensed real estate agent, and CEO of Clever Real Estate.

0 kommentar(er)

0 kommentar(er)